On Average, Companies Using a PEO, Save More Than $1,775 Annually Per Employee

The cost savings and overall benefits of partnering with a Professional Employer Organization (PEO) are substantial. By leveraging the expertise and resources of a PEO, small businesses can achieve significant cost savings, especially in areas like payroll and benefits administration, which can be expensive to manage in-house. PEOs can provide access to high-quality benefits at a lower cost due to their ability to pool resources across multiple clients. Additionally, PEOs can help reduce costs associated with non-compliance, as they stay up-to-date with the latest employment laws and regulations. Beyond cost savings, PEOs also offer invaluable benefits such as freeing up time for business owners to focus on growth, improving employee satisfaction through better benefits, and reducing risk through expert risk management strategies. Overall, a PEO is a strategic investment that can lead to improved operational efficiency, cost savings, and business growth.

PEO Payroll and Tax Administration

Managing payroll and tax administration is a significant challenge for small businesses. Without a PEO, a small business owner might spend countless hours calculating wages, withholding taxes, and ensuring compliance with various tax regulations. Mistakes can lead to penalties and fines. A PEO takes over these responsibilities, ensuring accurate and timely payroll processing and tax administration, thus reducing the risk of errors and non-compliance.

Human Resources Management

Without a dedicated HR team, small business owners often find themselves handling everything from recruitment and onboarding to performance management and employee relations. This can be time-consuming and stressful. A PEO provides comprehensive HR management services, offering access to HR professionals who can efficiently handle these tasks, ensuring compliance with labor laws and regulations.

Benefits Administration

Attracting and retaining top talent is crucial for any business. However, without a PEO, a small business might struggle to offer competitive benefits due to the administrative burden and cost. A PEO can provide access to a wider range of benefits typically reserved for larger companies, such as health insurance, retirement plans, and wellness programs. They also handle benefits administration, freeing up your time to focus on other business aspects.

Risk Management

Risk management, including workplace safety and workers’ compensation claims, is a complex area where small businesses often struggle. Without a PEO, a business owner might find themselves navigating these issues alone, potentially leading to costly mistakes. PEOs have experts who can help develop and implement effective risk management strategies and provide training to ensure a safe and compliant workplace.

Regulatory Compliance

Keeping up with the ever-changing landscape of employment laws and regulations is a significant challenge for small businesses. Without a PEO, a business owner might spend hours researching these changes to ensure compliance, which can be time-consuming and confusing. PEOs have dedicated teams of experts who stay up-to-date with these changes, ensuring your business remains compliant and avoids costly fines and legal issues.

In conclusion, PEO services offer a comprehensive solution to many of the challenges faced by small businesses. By partnering with a PEO, you can focus on what you do best – growing your business. Whether it’s payroll and tax administration, HR management, benefits administration, risk management, or regulatory compliance, a PEO can provide the expertise and resources needed to handle these tasks efficiently and effectively.

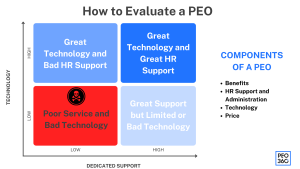

Choosing the right PEO for your business is crucial. Look for a PEO that understands your industry, has a proven track record, and offers a range of services that meet your specific needs. With the right PEO partner, you can overcome these challenges and set your business up for success.